salt tax deduction california

Entities are entitled to claim the 3 state income tax credit from their personal taxes as a result of the 3. Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction.

Stump Articles State And Local Tax Deduction Who Wins Who Loses 19 October 2017 18 24

California Enacts SALT Workaround.

. The California Elective Pass-Through Entity Tax Provides Business Owners a Salt Cap Tax Credit Workaround. Governor Newsom signed California AB 150 allowing owners of passthrough entities exception to 10000 federal cap on state and local tax SALT deductions for individuals. California Passes SALT Cap Work-Around.

California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and local taxes paid for individuals that was established by the Tax Cuts and Jobs Act of 2017 TCJA. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a workaround. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid.

Most state PTET elections follow the standard workaround formula for the SALT cap which was introduced under the 2017 Tax. Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB. Enacted by the Tax.

New law applicable to tax. Like other SALT workarounds Californias. On July 16 th the Governor signed AB 150 a budget trailer bill containing language outlining Californias PTE tax.

The trend among states to adopt elective pass-through entity taxes or PTETs. The Tax Cuts and Jobs Act passed in 2017 limits an individuals annual federal deduction for SALT paid to 10000 for tax years 2018 through 2025. California SB104 seeks to.

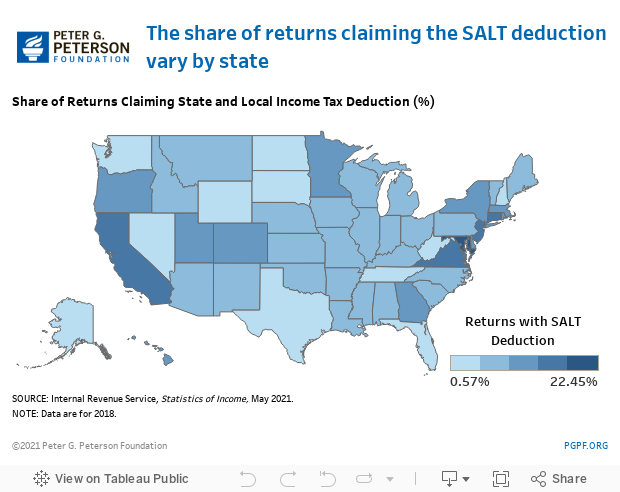

In 2014 3386 of California returns included a deduction for state and local taxes. California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by the 2017 tax reform that adopted elective pass-through entity PTE tax legislation. SB 113 which Governor Gavin Newsom signed into law on February 9 2022 expands the states workaround of the federal deduction limit for state and local taxes SALT and repeals the net operating loss NOL suspension and business credit limits.

The qualified taxpayer must make an annual election on a timely filed original tax return to pay an elective tax at a flat rate of 93 of the qualified net income for the taxable year. 150 which contains the Small Business Relief Act creating an elective pass-through entity PTE level tax available to certain. July 29 2021.

In a progressive state with high taxes many are discovering the bite the 10000 SALT cap is. On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass-through entities PTE from the current individual annual 10000 limitation on the deduction against federal taxable income for state and local taxes SALT paid. In 2021 Congress enacted the workaround to the SALT cap enabling corporate entities taxed as S corporations and partnerships to make a 9 tax payment.

The large CPA firm Grant Thorton reported that On July 16 2021 California Gov. While Congress has stalled on passing legislation that would eliminate in whole or in part the current limit on an individual taxpayers ability to take the itemized deduction for state and local taxes California has taken a dramatic step toward allowing many of its. That households so high on the income spectrum can expect a net tax cut from the Build Back Better Act is entirely due to the increase in the SALT deduction cap from 10000 to 80000 the.

Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction limit for state and local taxes the SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act or TCJA. What Are Salt Deductions In California. July 16 2021.

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. Gavin Newsom signed Assembly Bill 150 AB. 52 rows The SALT deduction allows you to deduct your payments for property tax payments and either.

As discussed in Part I of this article at least 22 states have adopted a pass-through entity taxor PTETelection for small business owner taxpayers seeking to avoid the 10000 federal deduction limit for state and local taxes. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California. As the first Tax Day without unlimited state and local tax deduction approaches an estimated 1 million California families will pay 12 billion more to Uncle Sam.

According to the Tax Foundation the. For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the elected tax. This article provides an overview of the California Pass-Through Entity Tax PTE which CPAs need.

Before the 2018 tax changes taxpayers who itemized their deductions were able to deduct the full amount paid in SALT taxes each year essentially avoiding paying taxes on their tax payments. Recently passed budget legislation in California will bring significant tax reductions to business and individual taxpayers. Then in December 2017 The Tax Cuts and Jobs Act TCJA capped the SALT deduction at 10000 thereby limiting a taxpayers itemized deductions and tax benefits.

The California SALT workaround helps a qualified taxpayer receive the tax benefit through a tax credit in the amount of PTE tax paid on their respective return. For many Californians and other taxpayers located in high-tax states like New York. Now SALT deductions are capped at 10000 the same for single and married taxpayers.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

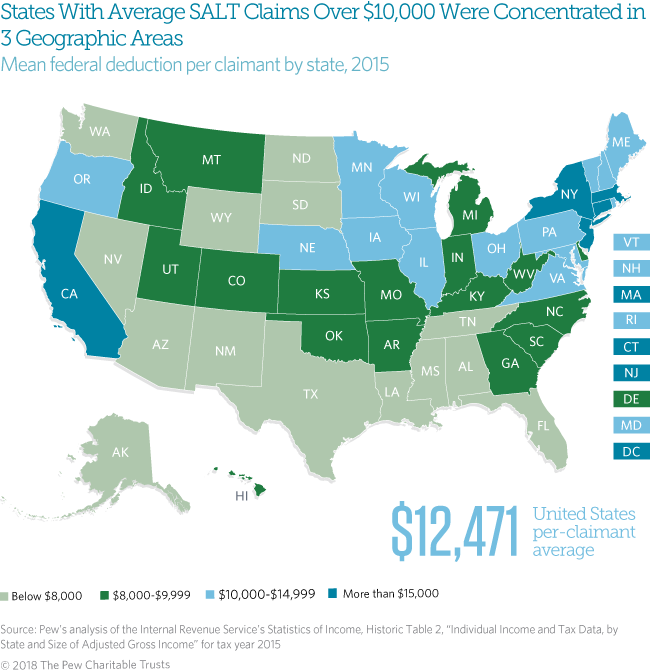

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

Poppy California Flower Bath Salt Flower Bath Floral Bath Salts Himalayan Pink Salt

California Solution For Federal State And Local Tax Salt Deduction Limitation Hayashi Wayland

Congressman Mike Garcia Introduces Bill To Repeal State Local Tax Deduction Cap

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

What Is Salt Tax Deduction Mansion Global

First Time Home Buyers Nikitas Kouimanis Mr Mortgage Fha Va Loans Real Estate Checklist Real Estate Tips Real Estate Marketing

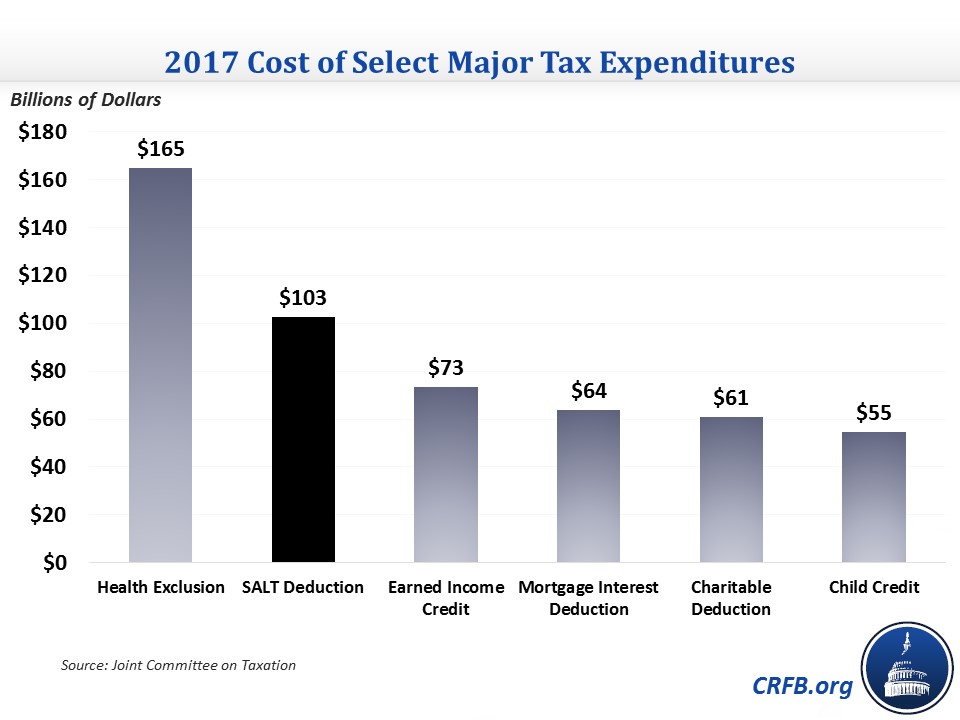

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

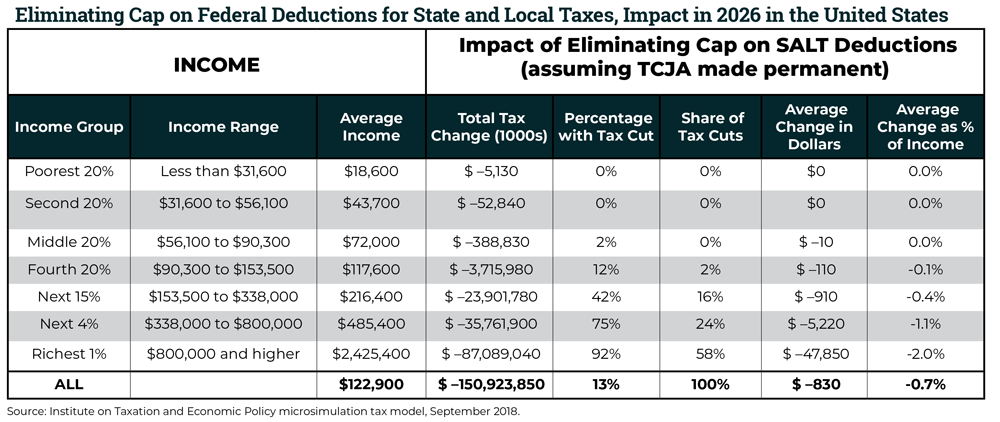

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Salt Deduction Salt Deduction Taxedu

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Tax Break Down The State And Local Tax Deduction Committee For A Responsible Federal Budget

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center